中国经济网北京5月6日讯 吉林银行近日发布2023年年度报告。2023年,吉林银行实现营业收入124.63亿元,同比增长25.55%;实现净利润18.89亿元,同比增长22.65%;实现归属于母公司股东的净利润20.54亿元,同比增长18.35%;归属于母公司股东的扣除非经常性损益净利润21.49亿元,同比增长12.96%;经营活动产生的现金流量净额为170.61亿元,同比减少29.12%。

2023年,吉林银行的加权平均净资产收益率为5.02%,较上年增长0.55个百分点;扣除非经常性损益后的加权平均净资产收益率为5.25%,较上年增长0.35个百分点。

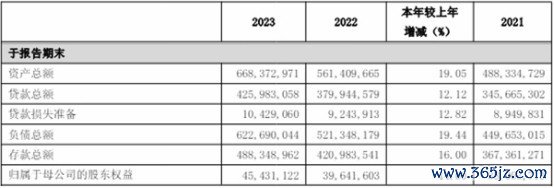

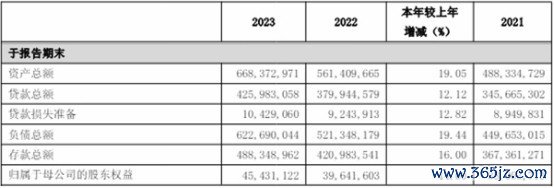

截至报告期末,吉林银行资产总额6,683.73亿元,较上年末增加1,069.63亿元,增幅19.05%;各项存款4,883.49亿元,较上年末增加673.65亿元,增幅16%;各项贷款4,259.83亿元,较上年末增加460.38亿元,增幅12.12%。

2023年,吉林银行实现利息净收入103.20亿元,上年同期为88.14亿元。其中,利息收入为248.30亿元,利息支出145.10亿元。

2023年,吉林银行实现投资收益12.46亿元,上年同期为10.06亿元。

报告期内,吉林银行计提信用减值损失43.00亿元,上年同期为35.17亿元,同比增长22.27%。

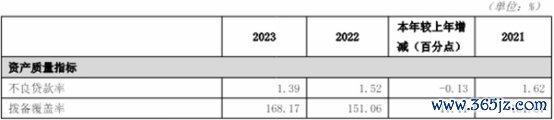

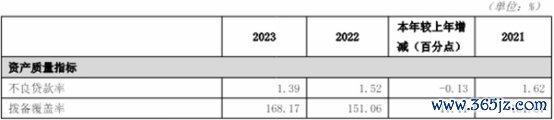

截至报告期末,吉林银行不良贷款率1.39%,较上年减少0.13个百分点;拨备覆盖率168.17%,较上年增长17.11个百分点。

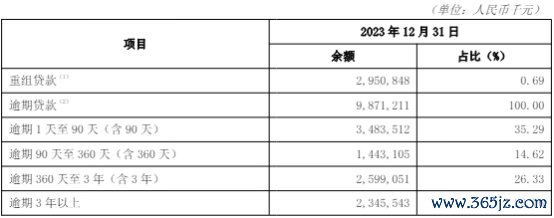

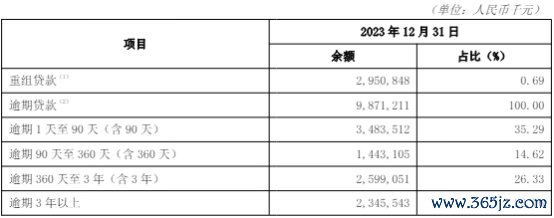

截至2023年12月31日,吉林银行逾期贷款余额98.71亿元。其中,逾期1天至90天(含90天)贷款余额34.84亿元,逾期90天至360天(含360天)贷款余额14.43亿元,逾期360天至3年(含3年)贷款余额25.99亿元,逾期3年以上贷款余额23.46亿元。

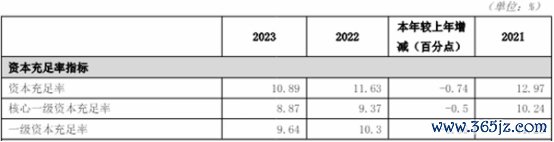

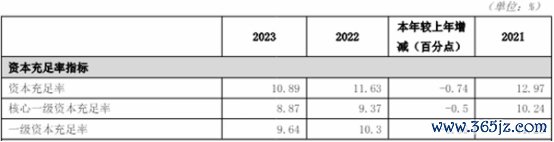

截至2023年12月31日,吉林银行的资本充足率、一级资本充足率、核心一级资本充足率分别为10.89%、9.64%、8.87%,较上年分别减少0.74个百分点、减少0.66个百分点、减少0.5个百分点。

报告期末,吉林银行员工在岗人数合计10,902人,年度薪酬总量合计249,867.16万元。

苏州线上配资

苏州线上配资

","del":0,"gnid":"9e9414cb696f2f0c1","img_data":[{"flag":"2","img":[{"desc":"","height":"120","title":"","url":"/uploads/allimg/240729/16322K644-6.jpg","width":"554"},{"desc":"","height":"142","title":"","url":"/uploads/allimg/240729/16322K1J-8.jpg","width":"554"},{"desc":"","height":"188","title":"","url":"/uploads/allimg/240729/16322J460-2.jpg","width":"554"},{"desc":"","height":"154","title":"","url":"/uploads/allimg/240729/16322Jc1-9.jpg","width":"554"},{"desc":"","height":"244","title":"","url":"/uploads/allimg/240729/16322L318-0.jpg","width":"554"},{"desc":"","height":"246","title":"","url":"/uploads/allimg/240729/16322LJ7-3.jpg","width":"554"},{"desc":"","height":"338","title":"","url":"/uploads/allimg/240729/16322L112-5.jpg","width":"554"},{"desc":"","height":"204","title":"","url":"/uploads/allimg/240729/16322H5P-1.jpg","width":"554"},{"desc":"","height":"218","title":"","url":"/uploads/allimg/240729/16322LK2-7.jpg","width":"554"}]}],"original":0,"pat":"art_src_1,fts0,sts0","powerby":"pika","pub_time":1714977540000,"pure":"","rawurl":"http://zm.news.so.com/e39a5c1f65090849cbebbbf1aa1daf21","redirect":0,"rptid":"1ccbaf1739fc6491","rss_ext":[],"s":"t","src":"中国经济网","tag":[{"clk":"keconomy_1:净资产收益率","k":"净资产收益率","u":""},{"clk":"keconomy_1:加权平均","k":"加权平均","u":""},{"clk":"keconomy_1:资本充足率","k":"资本充足率","u":""}],"title":"吉林银行2023年归母净利增18% 计提信用减值损失增22%","type":"zmt","wapurl":"http://zm.news.so.com/e39a5c1f65090849cbebbbf1aa1daf21","ytag":"财经:金融证券:股票","zmt":{"brand":{},"cert":"中国经济网官方账号","desc":"中国经济网是经济日报社主办的国家级重点新闻网站","fans_num":147430,"id":"2761082137","is_brand":"0","name":"中国经济网","new_verify":"4","pic":"https://p0.img.360kuai.com/t018c86cfc6da14214e.jpg","real":1,"textimg":"https://p9.img.360kuai.com/bl/0_3/t017c4d51e87f46986f.png","verify":"0"},"zmt_status":0}","errmsg":"","errno":0}

苏州线上配资

苏州线上配资